William Connell

In addition to overseeing the strategic direction of the firm, Bill is also the head of the investment team. Over 30 years, he has provided both retirement planning advice and portfolio management for individual investors.

Bill’s practice centers around helping automotive industry clients, church leadership, and busy working professionals serious about saving. Prior to founding LifeGuide Financial Consultants, Bill served as Senior Vice President at Wunderlich Securities. He was a Vice President and Sales Manager at Morgan Stanley where he mentored advisors.

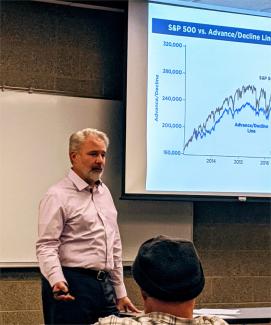

Bill has developed and uses an investment strategy we call the “Careful Capitalist”. The "Careful Capitalist" strategy seeks market growth with less volatility when compared to the overall stock market. The strategy also uses a sell discipline when the markets are in a major downtrend.

Throughout the year, Bill teaches an investment course he created at Schoolcraft College. The course focuses on providing attendees with a deeper understanding of investing and financial planning from the novice to the more advanced trader. He has served as a Trustee for the Michigan Opera Theater and has been a guest lecturer at Liberty University. Bill also participated in the State of Michigan Investor Protection Trust seminar series as a lecturer and counselor.

Bill earned his degree from Northwood University with a concentration in Economics. He has completed the FINRA Series 7, 8, 63, 65, 31 (held through LPL) and his Health and Life Insurance licenses. In addition to spending time with his wife and three adult children he also serves as a deacon at his local church. He is a “car guy” and enjoys Membership at Edgewood Country Club. He has used his love for cars to support things he cares about – raising money for food pantries like Love, Inc. and Promise Village homes for kids.

There is no guarantee that any investment strategy will be successful. Investing involves risk, including the potential loss of principal. LPL Financial is not affiliated with any other entities referenced.